Topic 6: Misc. Questions

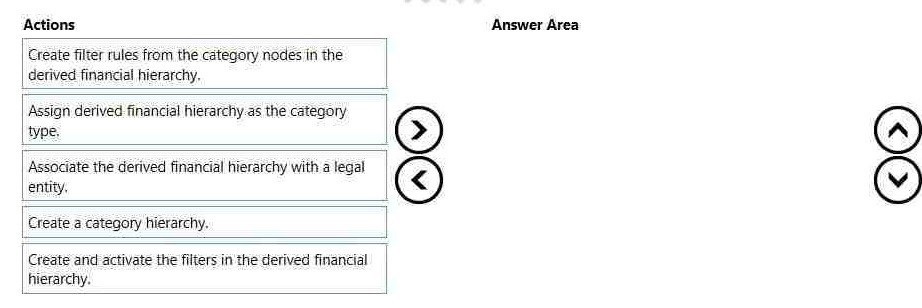

A public sector organization wants to set up the derived financial hierarchy to analyze

posted transaction data.

You need to set up the derived financial hierarchy to generate an outgoing electronic

document.

In which order should you perform the actions? To answer, move all actions from the list of

actions to the answer area and arrange item in the correct order

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to implement a quarterly accruals scheme for USMF. The accrual scheme

settings must match the settings of the monthly and annual accrual schemes.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

Look at the monthly and annual accrual scheme settings. Create a quarterly accrual

scheme with the same settings by using the following instructions:

Go to Navigation pane > Modules > General ledger > Journal setup > Accrual

schemes.

Select New.

In the Accrual identification field, type a value.

In the Description of accrual scheme field, type a value.

In the Debit field, specify the desired values. The main account defined will replace

the debit main account on the journal voucher line and it will also be used for the

reversal of the deferral based on the ledger accrual transactions.

In the Credit field, specify the desired values. The main account defined will

replace the credit main account on the journal voucher line and it will also be used

for the reversal of the deferral based on the ledger accrual transactions.

In the Voucher field, select how you want the voucher determined when the

transactions are posted.

In the Description field, type a value to describe the transactions that will be

posted.

In the Period frequency field, select how often the transactions should occur.

In the Number of occurrences by period field, enter a number.

In the Post transactions field, select when the transactions should be posted, such

as Monthly.

A client is using the budget planning process in Dynamics 365 for Finance and Operations.

Your client requires the ability to plan for a one-year, three-year, and five-year budget. You

need to configure the various year length options to be used in the budgeting module. What

should you do?

A.

Configure budget control.

B.

Configure budget codes.

C.

Configure budget allocation terms.

D.

Configure budget cycles.

Configure budget codes.

A company is preparing to complete yearly budgets.

The company plans to use the Budget module in Dynamics 365 Finance for budget

management.

You need to create the new budgets.

What should you do?

A.

Create budget plans for multiple scenarios.

B.

Create budget plans to define the revenues for a budget.

C.

Combine previous year budgets into a single budget.

D18912E1457D5D1DDCBD40AB3BF70D5D

Create budget plans for multiple scenarios.

Reference:

https://docs.microsoft.com/en-us/dynamics365/unifiedoperations/

financials/budgeting/budget-planningoverviewconfiguration

Note: This question is part of a series of questions that present the same scenario.

Each question in the series contains a unique solution that might meet the stated

goals. Some question sets might have more than one correct solution, while others

might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a

result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance. The customer creates a purchase order for

purchase $20,000 of office furniture.

You need to configure the system to ensure that the funds are reserved when the purchase

order is confirmed.

Solution: Set up posting definitions for purchase requisitions.

Does the solution meet the goal?

A.

Yes

B.

No

No

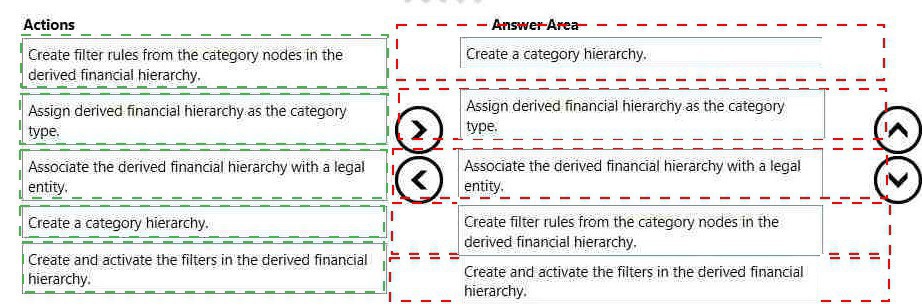

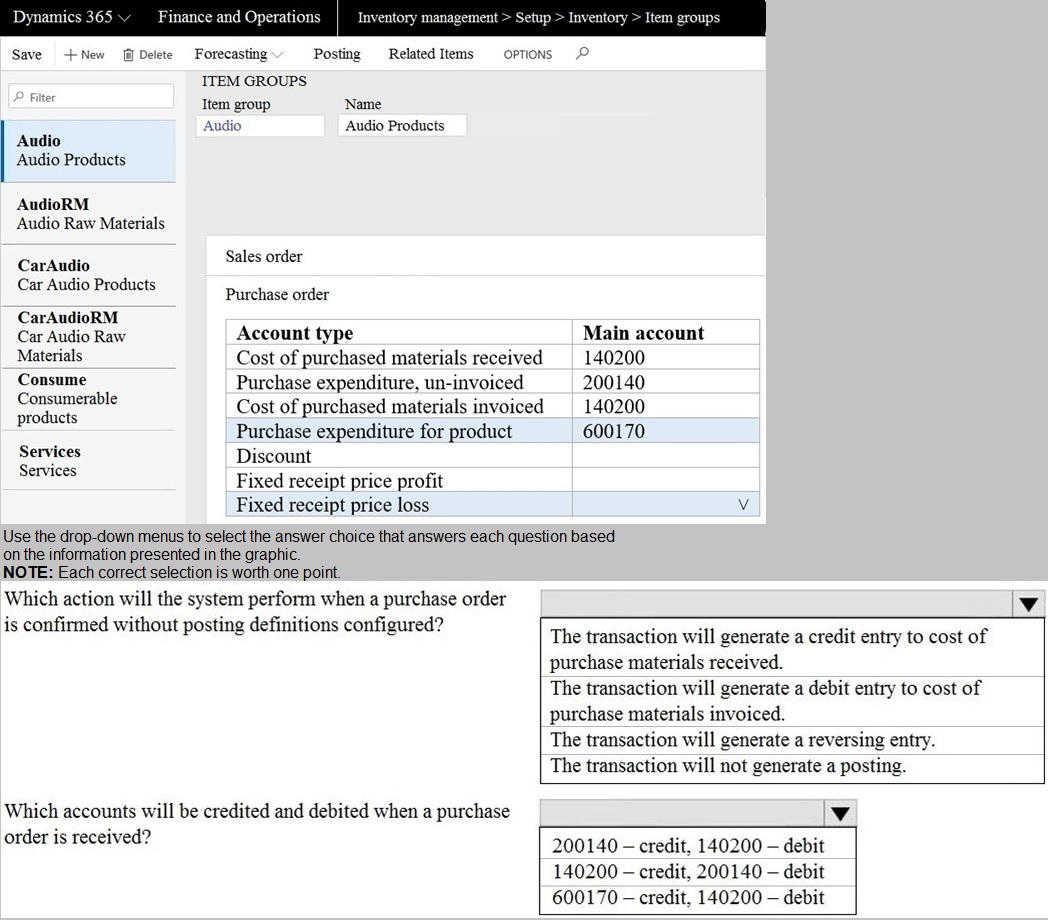

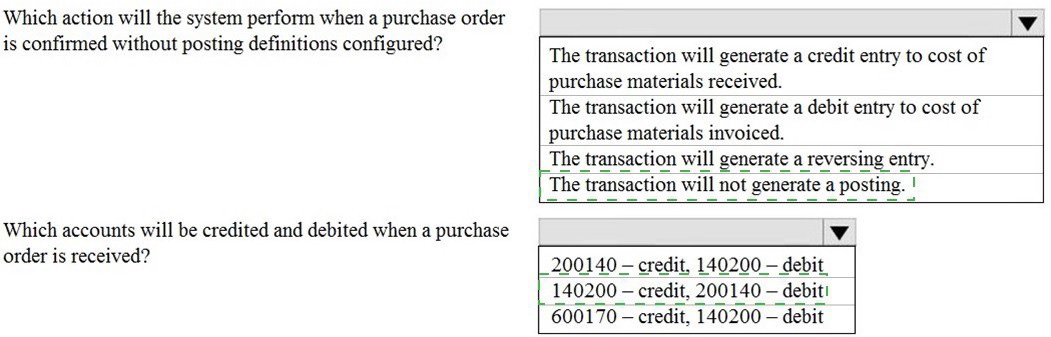

A private sector client needs item groups set up to support the procurement process.

The Audio Item group posting for a purchase order is configured as shown:

A company configures budget controls at the beginning of the year.

Which three budget control transaction actions occur when the budget control is turned off

mid-year. Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

A.

Activities are unrecorded for budget control purposes.

B.

Budget register entries that have been posted after budget control is turned off will not

be considered for budget control.

C.

Posted documents might incorrectly reflect any relieving amounts or balances in inquiries and reports that are related to budget control.

D.

Budget checks are performed.

You can view the budget reporting through financial reports.

E.

You can view the budget reporting through financial reports.

Activities are unrecorded for budget control purposes.

Budget register entries that have been posted after budget control is turned off will not

be considered for budget control.

Posted documents might incorrectly reflect any relieving amounts or balances in inquiries and reports that are related to budget control.

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF recently opened a new bank account in the Brazilian currency.

You need to create a new bank account in the system for the new bank account.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

1. Create a new bank account at Cash and bank management > Bank accounts > Bank

accounts.

2. Complete all required fields. The following list includes some fields that might be

required.

Bank account (code)

Bank account number

Main account - This is the general ledger account that is used for posting.

Currency

SWIFT code

3. Enter Brazil-specific information:

Select Bank in the Bank groups field. Confirm that the BIC and Corr. Bank

account fields are correct. Also, confirm Address and Contact information on

respective FastTabs and update accordingly.

Define the number series for payment order generation in the P/O

numeration field.

For bank accounts in foreign currency, you can also define .docx templates for

generation of payment orders in paper format in the following fields: Payment

order in currency, Order template (currency sale), and Order template (currency

purchase).

Note: This question is part of a series of questions that present the same scenario.

Each question in the series contains a unique solution that might meet the stated

goals. Some question sets might have more than one correct solution, while others

might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a

result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance. The customer creates a purchase order for

purchase $20,000 of office furniture.

You need to configure the system to ensure that the funds are reserved when the purchase

order is confirmed.

Solution: Configure item posting groups for purchase requisitions.

Does the solution meet the goal?

A.

Yes

B.

No

No

You are a functional consultant for Contoso Entertainment System USA (USMF).

You plan to run several reports in USMF that list all the write-off transactions.

You need to replace the write-off reason used by the system for USMF to use a reason of

“Bad debts.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

You need to add a write-off reason for USMF and set it as the default.

Go to Navigation pane > Modules > Credit and collections > Setup > Accounts

receivable parameters.

Click the Collections tab.

Click the Edit icon in the Write-Off section.

Add a new Write-Off reason if it doesn’t exist.

You are configuring account structures and advanced rules in Dynamics 365 Finance.

All balance sheet accounts require Business Unit and Department dimensions.

The Shareholder distribution account requires an additional dimension for Principal.

You need to set up the account structures.

What are two possible ways to achieve the goal? Each correct answer presents a complete

solution.

NOTE: Each correct selection is worth one point.

A.

Create a new main account for each of the company's principals. Then, create an

account structure for all balance sheet accounts that includes the required dimension.

B.

Create a new main account for Shareholder distribution. Add an advanced rule for the

Principal dimension.

C.

Create an account structure for all the balance sheet accounts. Set up an advanced rule

for the Shareholder distribution account for the Principal dimension.

D.

Create an account structure for balance sheet accounts without Shareholder distribution.

Then, create a second account structure for Shareholder distribution that includes all

required dimensions.

Create an account structure for all the balance sheet accounts. Set up an advanced rule

for the Shareholder distribution account for the Principal dimension.

Create an account structure for balance sheet accounts without Shareholder distribution.

Then, create a second account structure for Shareholder distribution that includes all

required dimensions.

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-accountstructures

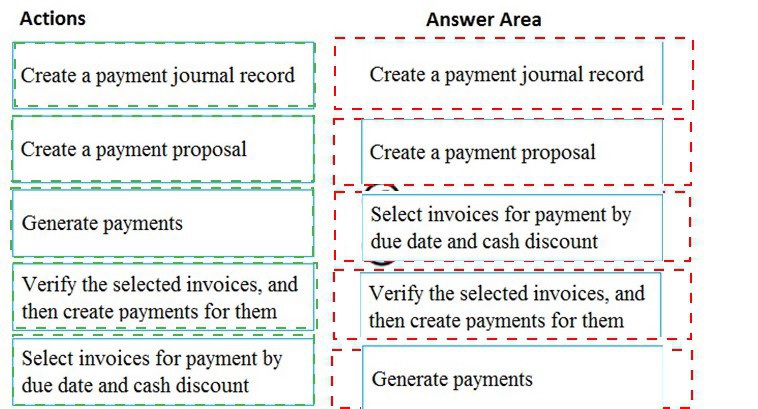

A company makes frequent payments to its vendors by using various due dates and

discounts.

You need to set up and create a vendor payment by using a payment proposal.

In which order should you perform the actions? To answer, move all actions from the list of

actions to the answer area and arrange them in the correct order.

| Page 7 out of 19 Pages |

| Previous |