Topic 6: Misc. Questions

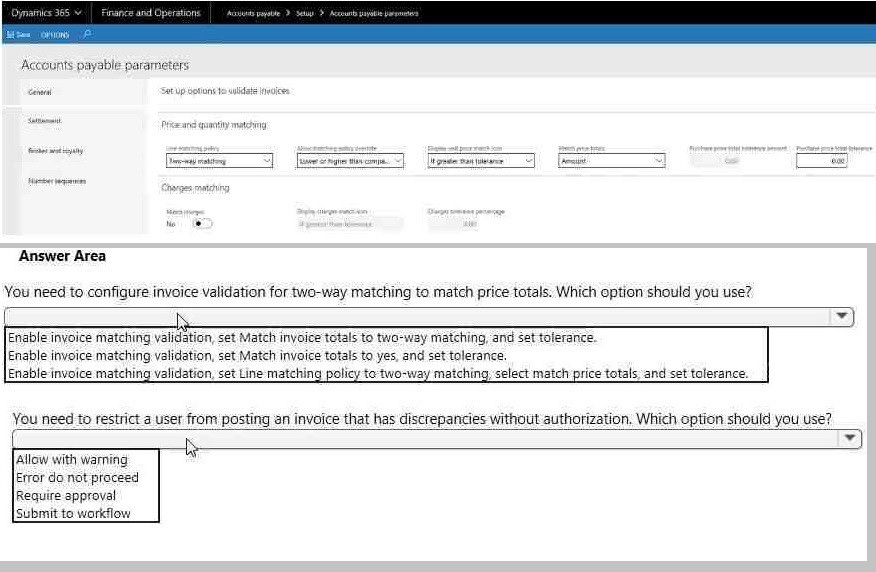

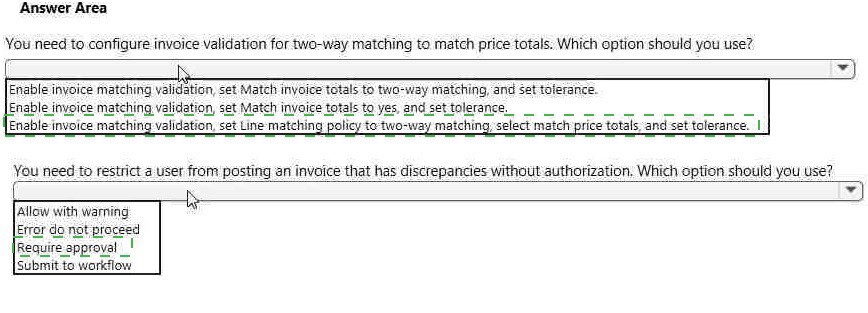

You need to configure invoice validation for vendors in Dynamics 365 for Finance and

Operations. You are viewing the Accounts payable parameter for Invoice validation.

A client is implementing Accounts payable. The client wants to establish three-way

matching for 100 of their 5,000 stocked items from a specific vendor.

The client requires the ability to have items that require only two-way matching and specific

items that require three-way matching.

You need to configure the system in the most efficient manner to achieve these

requirements.

What should you do?

A.

Configure a company matching policy of a three-way match.

B.

Configure a company matching policy of two-way matching and specify the items that

require a three-way match.

C.

Configure a company matching policy of two-way matching and set the matching policy

for specific item, and vendor combination level to three-way matching.

D.

Configure a company matching policy of non-required and specify the items that require

a three-way match.

E.

Configure a company matching policy of two-way matching and specify the vendors that

require a three-way match.

Configure a company matching policy of two-way matching and set the matching policy

for specific item, and vendor combination level to three-way matching.

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/accountspayable/

tasks/set-up-accounts-payable-invoice-matching-validation

You are a finance consultant. Your client needs you to configure cash flow forecasting.

The client wants specific percentages of main accounts to contribute to different cash flow

forecasts for other

main accounts.

You need to configure Dynamics 365 for Finance to meet the needs of the client.

What should you do?

A.

A the Cash flow forecasting setup form, configure the primary main account to assign a

percentage to the

dependent account.

B.

Configure the parent/child relationship for the main account and subaccounts by using

appropriate

percentages.

C.

Configure the cash flow forecasting setup for Accounts Payable before you configure

vendor posting

profiles.

D.

On the Cash flow forecasting setup form, use the Dependent Accounts setup to specify

which account and

percentage is associated to the main account.

D18912E1457D5D1DDCBD40AB3BF70D5D

On the Cash flow forecasting setup form, use the Dependent Accounts setup to specify

which account and

percentage is associated to the main account.

D18912E1457D5D1DDCBD40AB3BF70D5D

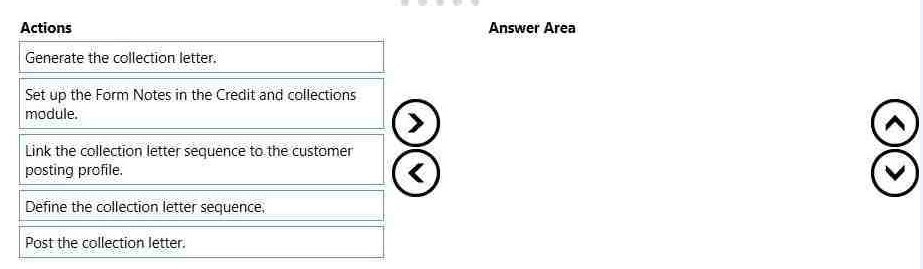

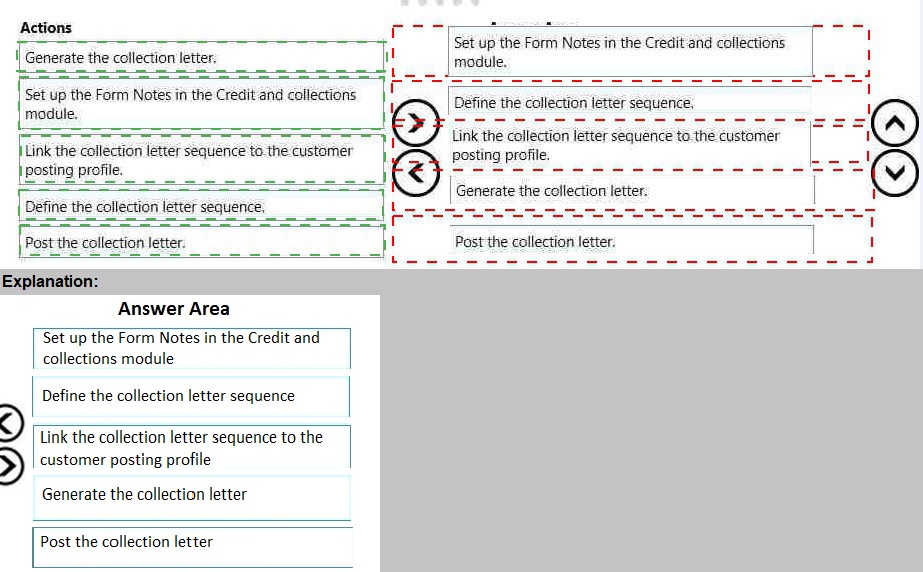

A client observes that some customers are late paying their invoices. The client wants to

use the Credit and Collections functionality to send collection letters to customers.

need to configure the system to support collection letter functionality and processing.

In which order should you perform the actions? To answer, move all actions from the list of

actions to the answer area and arrange them in the correct order.

A client has multiple legal entities set up in Dynamics 365 for Finance and Operations. All

companies and data reside in Finance and Operations.

The client currently uses a separate reporting tool to perform their financial consolidation

and eliminations. They want to use Finance and Operations instead.

You need to configure the system and correctly perform eliminations.

Solution: Set up Elimination rules in the system. Then, run an elimination proposal.

Configure the rules to post to any company that has Use for financial elimination process

selected in the legal entity setup.

Does the solution meet the goal?

A.

Yes

B.

No

Yes

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unifiedoperations/

financials/budgeting/consolidation-elimination-overview

You are the controller for an organization. The company purchased six service trucks. You

observe that your

accountant set up Fixed assets – vehicles in the wrong fixed asset group.

You need to achieve the following:

Change the fixed asset group so that the existing fixed asset transactions for the

original fixed asset are

canceled and regenerated for the new fixed asset.

Ensure that all value models for the existing fixed asset are created for the new

fixed asset. Any information

that was set up for the original fixed asset is copied to the new fixed asset.

Close the old fixed asset number in the old fixed assets group and create a new

fixed asset number in the

new fixed assets group.

Ensure that the historical transactions are transferred to the new fixed asset.

Ensure Historical Depreciation expense entries do not change.

What should you do?

A.

Reclassify the fixed asset

B.

Change the fixed asset group and keep the same fixed asset number

C.

Copy the fixed asset

D.

Transfer the fixed asset

Reclassify the fixed asset

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/fixedassets/

tasks/reclassify-fixed-assets

A food manufacturer uses commodities such as beans, corn, and chili peppers as raw

materials. The prices of the commodities fluctuate frequently. The manufacturer wants to

use cost versions to simulate these fluctuations.

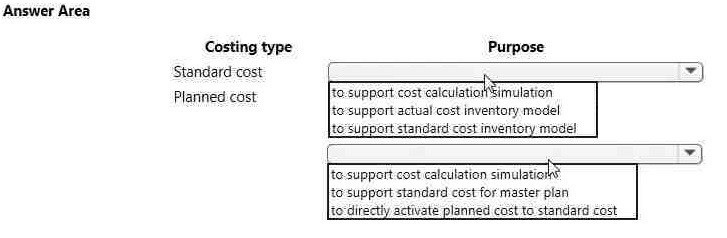

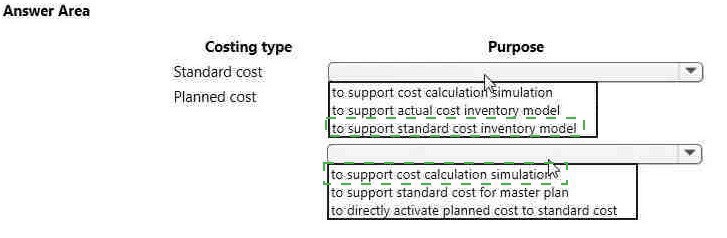

You need to set up cost versions and prices to accomplish the manufacturer's goal.

For which purpose should you use each costing type? To answer, select the appropriate

options in the answer area.

NOTE: Each correct selection is worth one point

You are configuring intercompany accounting for a multicompany enterprise. You need to

set up: the Due to and Due from accounts.

Which main account type should you use?

A.

Expense

B.

Asset

C.

Balance sheet

D.

Liability

E.

Profit and loss

Balance sheet

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/generalledger/

intercompany-accounting-setup

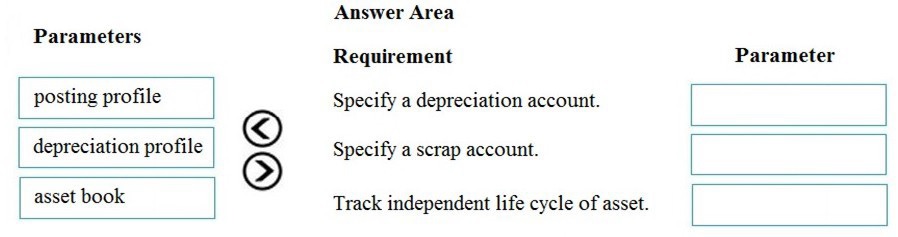

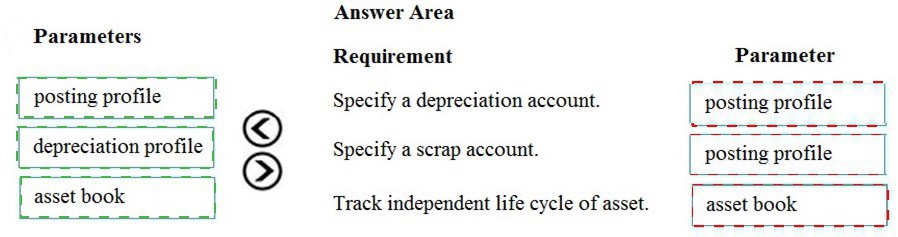

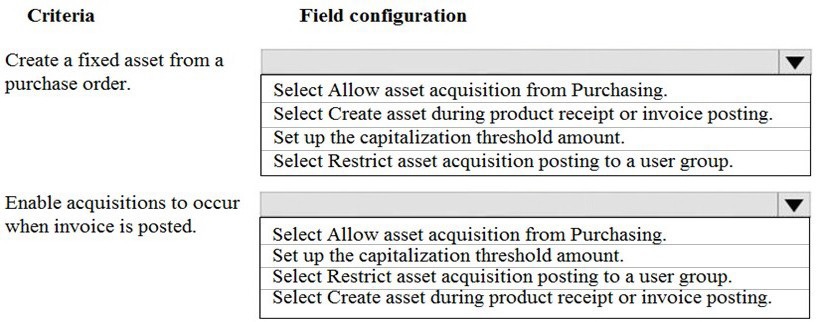

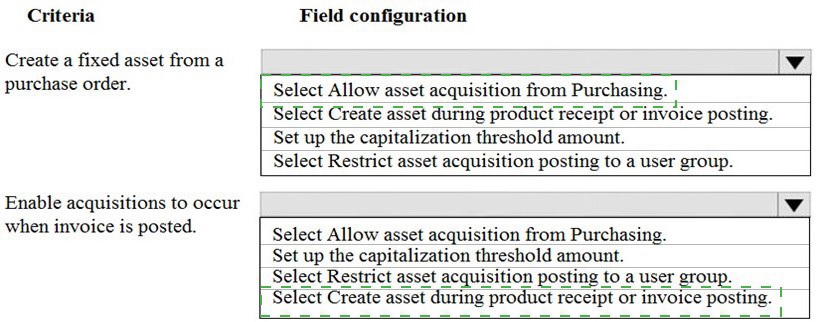

A client is implementing fixed assets in Dynamics 365 Finance.

You need to specify which parameters should be configured to meet the business

requirements.

Which parameters meet the requirements? To answer, drag the appropriate parameters to

the correct requirements. Each parameter may be used once, more than once, or not at all.

You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to generate a trial balance report for the period of January 1, 2017 to December

31, 2017. To validate you results, save the file in Microsoft Excel format to the

Downloads\Trial folder.

To complete this task, sign in to the Dynamics 365 portal.

Answer: See explanation below.

Explanation:

Click General ledger > Reports > Transactions > Trial Balance

Enter the Start and End dates for the report.

Click Destinations ... to specify how you want to ‘print’ the report.

Select File as the destination.

Select the Downloads\Trial folder for the location.

Select Microsoft Excel for the file format.

Click OK to close the ‘Print destination settings’ form.

Click OK to ‘print’ (save) the report to the selected destination

You are the purchase manager of an organization. You purchase a laptop for your office for

$2,000. You plan to create a purchase order and acquire the new fixed asset through the

purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product

receipt or vendor invoice posting and the capitalization threshold for the computers group

(COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition

transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer,

select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

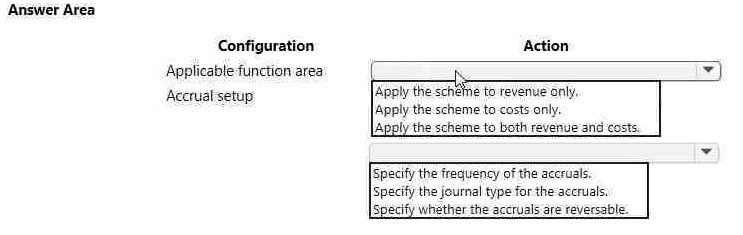

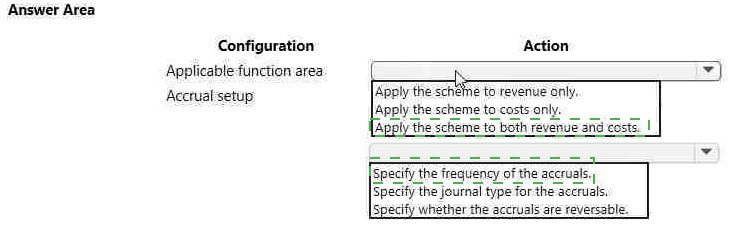

A rental service company hires you to configure their system to implement accrual

schemes.

You need to configure the accrual schemes for this company.

Which configuration and transaction options should you use? To answer, select the

appropriate options in the answer area.

NOTE: Each correct selection is worth one point

| Page 6 out of 19 Pages |

| Previous |